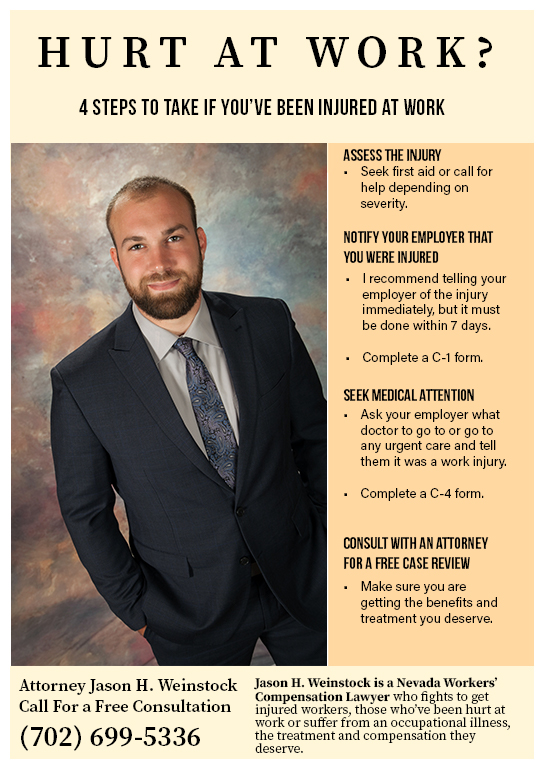

Getting hurt anywhere can be a scary experience but can be even more frightening when it happens at work. On top of the pain associated with the injury, my clients often also express fear of losing their job and costly medical bills. It is important to remember that accidents happen, and Nevada’s workers’ compensation system is a non-fault system. A valid work injury covered by workers’ compensation insurance provides the benefit of covering your medical treatment with no out-of-pocket costs, unlike private health insurance. Here are 4 steps to take if you’ve been injured at work:

1) Assess your injury!

Work accidents happen in many ways and result in different forms of physical or mental injuries. Your health and safety should be your first concern. It should also be your employer’s first concern. Evaluate your injury and seek first aid or call for help depending on severity. Sometimes assessing the injury only requires taking a second to sit down and catch your breath, or sometimes it requires emergency transport to a hospital. Take a second to recognize what happened, what hurts, and what immediate treatment you might need.

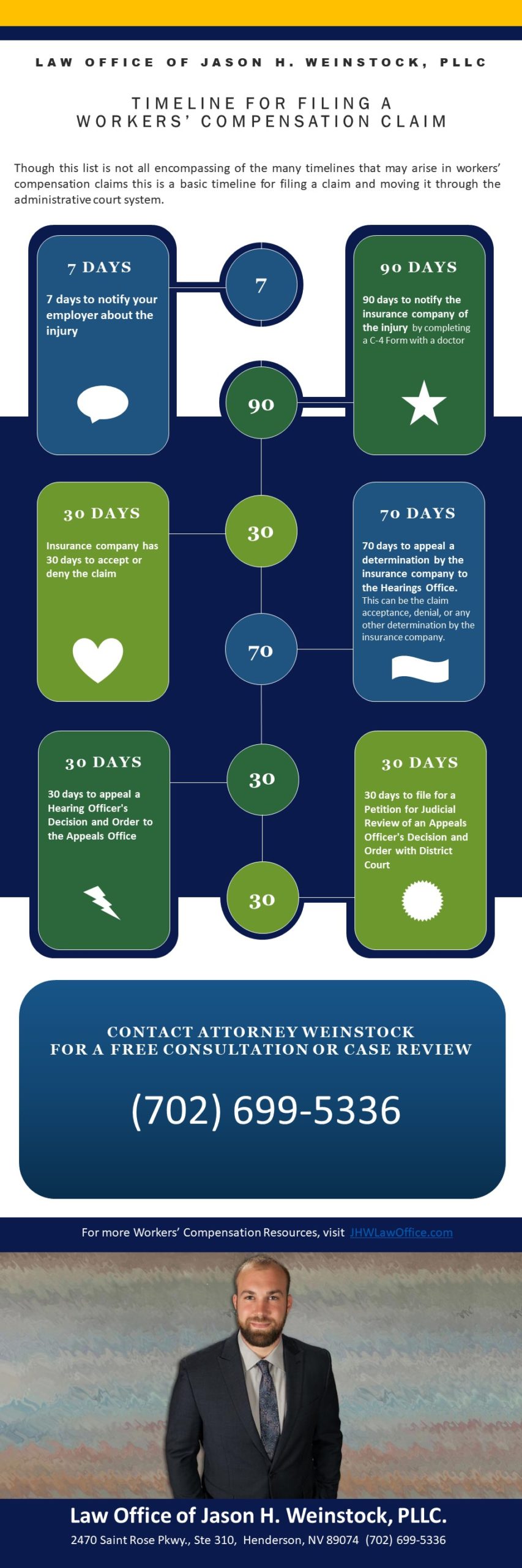

2) Notify your employer that you were injured!

Tell your employer about the accident or injury immediately or as soon as possible. NRS 616C.015 requires an injured employee to notify their employer of the injury “as soon as practicable, but within 7 days.”

Too often I have clients that come to me with a denied claim because they did not report the injury to their employer within the 7 days. Their reasoning is not that they didn’t actually get hurt at work but rather they wanted to wait to see if they got better before they “made it a big deal.” While this is completely understandable and in the “real world” a totally normal thing to do, workers’ compensation insurance companies will use this against you.

An example of this is a construction worker who is lifting something heavy, hears a pop and feels pain in his back. He takes some Tylenol and thinks he will sleep it off over the next few days. Eight days later he realizes his back is not getting better and he tells his employer about the injury.

I recommend telling your employer of the accident and injury as soon as it happens, if possible, even if you do not know the severity yet. Your employer should have you complete a C-1 Form also called a Notice of Injury or they may have their own accident report forms. Ask to complete a written accident statement if one is not automatically given to you to complete.

3) Seek Medical Attention!

Although this also falls under number 1 (assess your injury), it is important to mention it again for injured employees like those in the example above. Completing a C-4 Form, also known as a Request for Compensation, is what starts initiates the workers’ compensation insurance claim. This form must be completed by a doctor within 90 days. You may not feel that your injury is severe enough to seek medical attention the instant it happens, that is why the legislature allows you 90 days to see a doctor and file a claim for compensation per NRS 616C.020.

Using the example above, let’s say the construction worker told his employer of the pop and pain in his back the day it happened but wanted to see if the pain would go away on its own in a few days. Even if the construction worker waits 2 months (I DO NOT RECOMMEND THIS), he would still fall within the statutory requirement of reporting a claim within 90 days.

4) Consult with an attorney for a free case review!

Many workers’ compensation attorneys, like myself, offer free consultations and will review your case with you. Although not every workers’ compensation claim will require an attorney’s assistance, taking advantage of a free consultation is always a good idea.

I recently wrote a blog on the types of benefits offered by workers’ compensation insurance. An experienced workers’ compensation attorney will be able to ensure you are receiving all the benefits that you are owed. An experienced workers’ compensation attorney can help you gather evidence and medical records and will also be able to assist in finding the appropriate doctor or getting treatment approved.

Give me a call or send an email for a free consultation if you have questions or concerns about your Nevada workers’ compensation claim, filing a claim, or workers’ compensation benefits and deadlines.