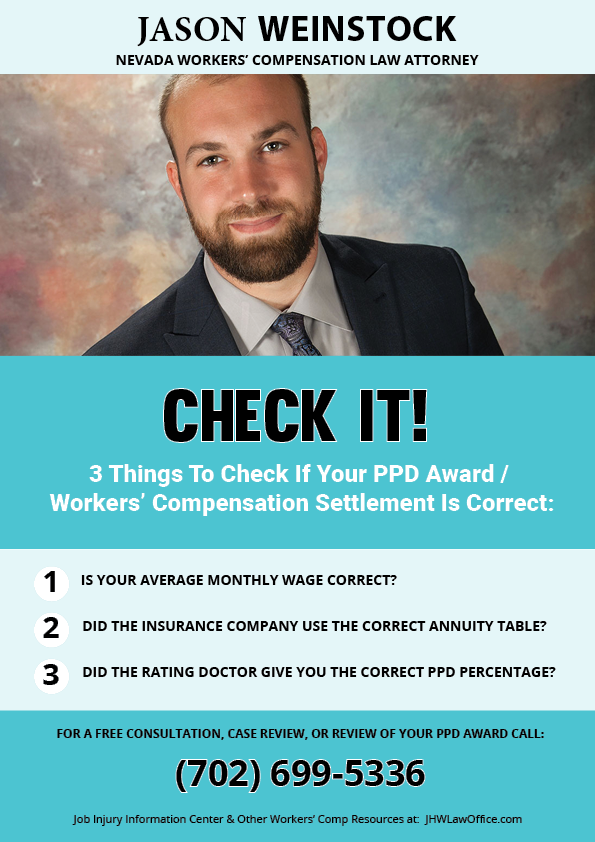

Frequently I am asked by potential clients and current clients whether there is a settlement at the end of their workers’ compensation case or how much their case is worth. This question is often hard or impossible to answer. Sometimes, I can estimate whether I think you are likely to have a permanent partial disability (PPD) award and ballpark what I think it might equate to. However, your PPD award or workers’ compensation settlement is a figure that is based on your rating percentage, your age, your average monthly wage, and a figure from the applicable annuity table. For purposes of this blog a PPD award and a workers’ compensation “settlement” are the same thing. Below are 3 things to check to determine if your PPD award / workers’ compensation settlement is correct.

-

Is your average monthly wage correct?

Your average monthly wage is a figure that is determined by your workers’ compensation adjuster, which they use to calculate your temporary total, temporary partial, permanent partial, and permanent total disability benefits.

The workers’ compensation insurance adjuster will request your wage information from your employer through a D-8 form. There are two ways to calculate average monthly wage, through a 84 days and 1 year wage history. The workers’ compensation adjuster should also factor in any concurrent (second job) employment you had at the time of the injury. The adjuster must use the highest average monthly wage figure.

The higher your average monthly wage the higher your PPD award / workers’ compensation settlement.

-

Did the insurance company use the correct annuity table?

An annuity table is a set of figures that conform to a person’s age, the inflation rate, interest rates, and life expectancy. These tables are created by an actuary and adopted by the Division of Industrial Relations (DIR) every year on July 1st. The workers’ compensation insurance company must use the table that has been adopted by the DIR at the time the injured worker accepts the PPD award. Meaning if your workers’ compensation adjuster made the PPD award offer on June 28th and you accept the award on July 2nd they must recalculate the PPD award using the new tables. The current annuity table can be found here.

-

Did the rating doctor give you the correct PPD percentage?

At the end of all your treatment for a work-related injury your workers’ compensation doctor will state whether you have a ratable impairment. A ratable impairment means you have a lasting effect from the injury you suffered at work, otherwise known as a permanent disability. A permanent disability does not always equate to the same thing as a disability in the eyes of, for example, social security disability. In workers’ compensation this permanent disability if established using the AMA Guides to the Evaluation of Permanent Impairment. Nevada uses the 5th Edition of the AMA Guides to the Evaluation of Permanent Impairment. Your percentage of impairment can be determined by your symptoms, your range of motion, and the type of treatment you had.

Common errors made my rating doctors include incorrect apportionment (subtracting from the total impairment for possible prior injuries), not evaluating all accepted body parts, and not thoroughly examining the medical records.

The higher the impairment percentage the higher the PPD award / workers’ compensation settlement.