Most people who call me about their Nevada workers’ compensation claims tell me that they just want to get decent medical treatment and get on with their lives. They usually say something about not pursuing a claim just to get money. They emphasize that they like their jobs, and they don’t want their employers to think less of them because they have hired a lawyer to get them medical care or benefit checks after trying to deal with an insurance company that acts like they don’t exist. However, all injured workers should know a few things about money awards. Here are a few facts about money and your workers’ comp claim:

Most people who call me about their Nevada workers’ compensation claims tell me that they just want to get decent medical treatment and get on with their lives. They usually say something about not pursuing a claim just to get money. They emphasize that they like their jobs, and they don’t want their employers to think less of them because they have hired a lawyer to get them medical care or benefit checks after trying to deal with an insurance company that acts like they don’t exist. However, all injured workers should know a few things about money awards. Here are a few facts about money and your workers’ comp claim:

1. The amount of off work compensation benefits (TTD benefits) depends on how much money you were earning 12 weeks before your injury, unless special circumstances apply.

This is the basic rule used to calculate benefits, and there are special circumstances that may apply to you that will allow an increase in the average monthly wage figure used by the insurer to calculate your benefits. There is also a maximum average monthly wage and maximum benefit that changes on July 1 of each year. Right now, the maximum amount an injured worker can receive each month she is off work for an injury occurring after July 1, 2009 is $3,472.40. As this average monthly wage figure is also used to calculate any permanent partial disability award at the end of your claim for any permanent injuries, you will want to make sure that the insurer is using the highest possible figure on your claim. For more information on how benefits are calculated, click here.

2. There is no pain and suffering awarded on a work injury claim.

Any money paid on a work injury claim is paid strictly in accordance with a set of laws and regulations governing workers’ compensation claims in Nevada. Money damages awarded by juries (or judges) for "pain and suffering", or lost of enjoyment of life, or loss of earning capacity, are related to personal injury lawsuits and not workers’ compensation claims. There are some circumstances that would allow an injured worker with a work injury claim to also file a personal injury lawsuit against the person or corporation responsible for the accident ,so long as the employer or co-employee is not sued. In those circumstances, pain and suffering damages might also be awarded on the personal injury action.

3. Money awarded on work comp claims are for permanent injuries only.

You might have a terrible accident at work, causing you to be hospitalized for weeks, but if you fully recover for your injuries, you might not be entitled to a permanent partial disability award. There are two types of money settlements typically involved in a Nevada workers’ compensation claim involving serious injuries. One is the permanent partial disability award that is determined by a rating doctor when the treating physician releases you from further care. The rating doctor must apply the criteria in the AMA Guide to Evaluation of Permanent Impairment, 5th edition, to arrive at a whole person percentage of impairment. That percentage is then inserted into a mathematical formula that also uses your average monthly wage, and your chronological age to arrive at a lump sum of money for your permanent impairment. You must be familiar with the AMA Guides in order to know whether the percentage of impairment is correct and whether you should accept the offer by the insurer or file an appeal.

4. Insurers sometimes close files without offering PPD awards when awards should be given.

The insurer only schedules an impairment evaluation if the treating doctor states that it is likely that the patient has a ratable impairment. The problem is that many surgeons do not know what a "ratable impairment" is under the AMA Guides, and these doctors think that there is no ratable impairment if the patient is able to return to work full duty. I have seen many cases where injured workers were entitled to thousands of dollars on their claims for their injuries, and they never knew to question the insurer’s closure of their claims without a rating evaluation.

5. Rating doctors make mistakes frequently, costing injured workers thousands of dollars.

Theoretically, several rating doctors should arrive at the same percentage of impairment if several doctors were to examine and rate an injured worker. In reality, the same injured worker can be rated by several rating doctors, and the percentages come out differently. That can make a huge difference in the amount of money offered by the insurer. Again, either you or your attorney should know how to apply the criteria in the AMA Guides so that you are offered the correct and highest percentage of impairment. You also need to consider that it now costs $650 to obtain a second rating from the rotating list of rating doctors, and you don’t want to spend that amount if the first percentage offered is correct.

6. A vocational rehabilitation lump sum buy out can be negotiable.

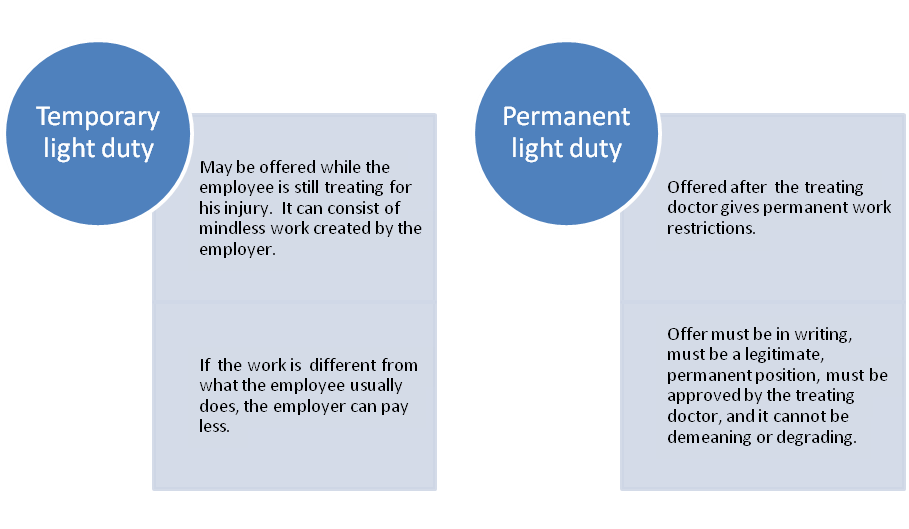

The second type of lump sum of money an injured worker can receive on his claim is a vocational rehabilitation lump sum buy-out. If the injured worker has permanent work restrictions, and if the employer does not offer a permanent light duty job, he is entitled to vocational rehab benefits. Those benefits usually consist of either a program of retraining, or a lump sum of money for the injured worker to go away and find a job or retraining on their own. It used to be that the insurer could offer 1 cent for a lump sum buy-out if it wanted to be particularly nasty. and the injured worker’s only option was to accept a retraining program. Now, the law requires the insurer to offer at least 40% of what the insurer would have to pay in monthly benefits if the injured worker had instead opted for a retraining program. What many injured workers do not know is that insurers can sometimes be persuaded to offer more than the minimum lump sum.

7. You can’t put a price on quality medical care.

The most important consideration in any work injury case is the quality of the medical care provided to the injured worker. Money is never a sufficient substitute for an injury that could have been treated by faster and better medical care. Injured workers must treat with doctors on their particular insurer’s provider list. It is essential that the injured worker obtain information as to which of the doctors on that list show consistently good surgical results, and which are fair to injured workers.

8. It may be difficult to predict how much money an injured worker will get for a PPD award at the outset of the claim.

When an injured worker comes for a consultation at the beginning of his claim, I may not be able to predict how much money will be awarded for a permanent partial disability award, because we don’t know to what extent the injury will heal after more months of treatment. All of the people I accept as clients want to get better. ( People who impress me as only trying to obtain money are not clients I want. ) Some injuries, such as amputations, are easily ratable under the AMA Guides, and I can give the injured worker an estimate of what to expect. Other injuries depend on loss of range of motion, or neurological testing, or a review of operative reports to determine an approximate percentage of impairment, and that is information that is usually unavailable at the beginning of a claim.

Most people who call me about their Nevada workers’ compensation claims tell me that they just want to get decent medical treatment and get on with their lives. They usually say something about not pursuing a claim just to get money. They emphasize that they like their jobs, and they don’t want their employers to think less of them because they have hired a lawyer to get them medical care or benefit checks after trying to deal with an insurance company that acts like they don’t exist. However, all injured workers should know a few things about money awards. Here are a few facts about money and your workers’ comp claim:

Most people who call me about their Nevada workers’ compensation claims tell me that they just want to get decent medical treatment and get on with their lives. They usually say something about not pursuing a claim just to get money. They emphasize that they like their jobs, and they don’t want their employers to think less of them because they have hired a lawyer to get them medical care or benefit checks after trying to deal with an insurance company that acts like they don’t exist. However, all injured workers should know a few things about money awards. Here are a few facts about money and your workers’ comp claim:

does not agree with the percentage of impairment found by the assigned rating doctor may obtain a second rating evaluation by paying this same fee for a second rating. However, if the injured worker does not think an exam is necessary in order for a second rating doctor to conclude that the first rating doctor made an error, he may pay the assigned second doctor $324.85 for a records review and report.

does not agree with the percentage of impairment found by the assigned rating doctor may obtain a second rating evaluation by paying this same fee for a second rating. However, if the injured worker does not think an exam is necessary in order for a second rating doctor to conclude that the first rating doctor made an error, he may pay the assigned second doctor $324.85 for a records review and report.